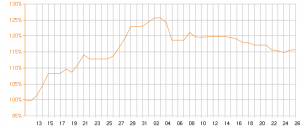

VILNIUS — Following a bullish month in January, the Baltic Nasdaq OMX stock exchange has leveled off and stagnated.

News about Estonia’s likeliness to join the eurozone buoyed investors’ moods at the thinly-traded markets in January, but February saw the release of most Baltic company results for 2009; many were in the red, devastated by [private_supervisor]weak domestic demand. Overall industrial production remains down from the year before, although the decline is ebbing. Meanwhile unemployment, currently at 13.8 percent continues to rise.

“For me it was not a surprise — we expected a faster move down, but we didn’t see such a drastic result as I expected,” SEB Bank stock broker Vydas Jacikevičius told Baltic Reports. “This is a market correction after a very bullish run in January and February was the month was the month when most companies reported 2009 results. These weren’t in the black, but the red.”

The bank could not account for January’s good form, but theorized that the market was driven by Estonia’s expectations of joining the eurozone by 2011.

“On the other hand, foreign markets were mixed and without trends, sometimes falling down and this had an effect on the market that you see,” Jacikevičius said. “The Estonian market rose and Vilnius followed up — maybe the market was oversold and I think a lot realized that Estonia is just one step from eurozone, or perhaps some managers got new funds for Baltics for investment.”

Over the next half year, the broker predicted that the market would remain relatively flat with some individual companies doing well.

All three Baltic countries have experienced problems with foreign investment recently because of widespread fears that their currencies could be devalued, despite government assurance to the contrary. All three currencies are pegged to the euro and use cash reserves to maintain the exchange rate.

Many investors see the region as one and fears that, particularly the Latvian lat, currencies could be devalued could mean that the other countries would suffer as a result.[/private_supervisor] [private_subscription 1 month]weak domestic demand. Overall industrial production remains down from the year before, although the decline is ebbing. Meanwhile unemployment, currently at 13.8 percent continues to rise.

“For me it was not a surprise — we expected a faster move down, but we didn’t see such a drastic result as I expected,” SEB Bank stock broker Vydas Jacikevičius told Baltic Reports. “This is a market correction after a very bullish run in January and February was the month was the month when most companies reported 2009 results. These weren’t in the black, but the red.”

The bank could not account for January’s good form, but theorized that the market was driven by Estonia’s expectations of joining the eurozone by 2011.

“On the other hand, foreign markets were mixed and without trends, sometimes falling down and this had an effect on the market that you see,” Jacikevičius said. “The Estonian market rose and Vilnius followed up — maybe the market was oversold and I think a lot realized that Estonia is just one step from eurozone, or perhaps some managers got new funds for Baltics for investment.”

Over the next half year, the broker predicted that the market would remain relatively flat with some individual companies doing well.

All three Baltic countries have experienced problems with foreign investment recently because of widespread fears that their currencies could be devalued, despite government assurance to the contrary. All three currencies are pegged to the euro and use cash reserves to maintain the exchange rate.

Many investors see the region as one and fears that, particularly the Latvian lat, currencies could be devalued could mean that the other countries would suffer as a result.[/private_subscription 1 month] [private_subscription 4 months]weak domestic demand. Overall industrial production remains down from the year before, although the decline is ebbing. Meanwhile unemployment, currently at 13.8 percent continues to rise.

“For me it was not a surprise — we expected a faster move down, but we didn’t see such a drastic result as I expected,” SEB Bank stock broker Vydas Jacikevičius told Baltic Reports. “This is a market correction after a very bullish run in January and February was the month was the month when most companies reported 2009 results. These weren’t in the black, but the red.”

The bank could not account for January’s good form, but theorized that the market was driven by Estonia’s expectations of joining the eurozone by 2011.

“On the other hand, foreign markets were mixed and without trends, sometimes falling down and this had an effect on the market that you see,” Jacikevičius said. “The Estonian market rose and Vilnius followed up — maybe the market was oversold and I think a lot realized that Estonia is just one step from eurozone, or perhaps some managers got new funds for Baltics for investment.”

Over the next half year, the broker predicted that the market would remain relatively flat with some individual companies doing well.

All three Baltic countries have experienced problems with foreign investment recently because of widespread fears that their currencies could be devalued, despite government assurance to the contrary. All three currencies are pegged to the euro and use cash reserves to maintain the exchange rate.

Many investors see the region as one and fears that, particularly the Latvian lat, currencies could be devalued could mean that the other countries would suffer as a result.[/private_subscription 4 months] [private_subscription 1 year]weak domestic demand. Overall industrial production remains down from the year before, although the decline is ebbing. Meanwhile unemployment, currently at 13.8 percent continues to rise.

“For me it was not a surprise — we expected a faster move down, but we didn’t see such a drastic result as I expected,” SEB Bank stock broker Vydas Jacikevičius told Baltic Reports. “This is a market correction after a very bullish run in January and February was the month was the month when most companies reported 2009 results. These weren’t in the black, but the red.”

The bank could not account for January’s good form, but theorized that the market was driven by Estonia’s expectations of joining the eurozone by 2011.

“On the other hand, foreign markets were mixed and without trends, sometimes falling down and this had an effect on the market that you see,” Jacikevičius said. “The Estonian market rose and Vilnius followed up — maybe the market was oversold and I think a lot realized that Estonia is just one step from eurozone, or perhaps some managers got new funds for Baltics for investment.”

Over the next half year, the broker predicted that the market would remain relatively flat with some individual companies doing well.

All three Baltic countries have experienced problems with foreign investment recently because of widespread fears that their currencies could be devalued, despite government assurance to the contrary. All three currencies are pegged to the euro and use cash reserves to maintain the exchange rate.

Many investors see the region as one and fears that, particularly the Latvian lat, currencies could be devalued could mean that the other countries would suffer as a result.[/private_subscription 1 year]

— This is a paid article. To subscribe or extend your subscription, click here.